고정 헤더 영역

상세 컨텐츠

본문

Despite a small slowdown in the growth of the CRM applications market, overall growth was up 11.2 percent year-over-year for the second half of 2011, down slightly from the first half of the year, according to IT research firm IDC's latest Worldwide Semiannual CRM Applications Tracker, which covers more than 190 global and local CRM vendors across a total of 49 countries.As growth continues, the competition among CRM vendors is escalating as market leads start to get slim. Among the top five CRM vendors worldwide, Oracle holds a slight lead, with 11 percent market share, followed by SAP, with 9.9 percent share, with Salesforce.com fast behind it, with a 9.5 percent stake.

- Source: CRM Applications market includes the following IDC-defined functional markets: Sales, Customer Service, Contact Center, and Marketing Applications. Source: CRM Applications market includes the following IDC-defined functional markets: Sales, Customer Service, Contact Center, and Marketing Applications.

- Last year Salesforce led the pack with a 25% market share riding on a 23% jump in CRM revenues. Adobe was #2, followed by Oracle, SAP and Genesys. Through our forecast period, the CRM applications market is expected to reach $29.7 billion by 2022, compared with $27.1 billion in 2017 at a compound annual growth rate of 1.9%.

CRM vendors which fail to grow their CRM revenues by these figures are by definition in market share decline. According to Gartner, the CRM software market reached $23.2B in 2014, up from $20.4B in 2013, representing a 13.3% annual growth.

Avaya and SEC rounded out the top five with market shares of 3.6 percent and 3.3 percent, respectively. CRM vendors categorized under other comprised 62.7 percent of the market, according to IDC figures.Geographically, Oracle holds the lead in the Asia-Pacific region outside of Japan, while SAP has established itself as the leader in the Europe, Middle East and Africa (EMEA), as well as the Latin American markets. Salesforce.com is currently doing well in the North American and Japanese markets. The competitive scenario for the worldwide CRM applications market is becoming decidedly more interesting, the report noted.The Americas and Japan outperformed other geographic areas in the second half of the year, according to IDC research, while emerging markets like Latin America and the Asia-Pacific markets gained 0.7 of market share, compared to 2010. IDC predicted these economies, led by strong economic performances in China, Russia and Brazil, would drive further growth in the CRM software market.

Further reading.Among the four functional markets that comprise the CRM applications spacecontact centers, marketing automation, sales automation and customer serviceonly contact centers grew at a single-digit rate, while the three others posted growth in the double digits. Despite continued growth in 2012 to 2016 forecast period, the report predicted contact center applications would lose an additional 3.4 percent through 2016.' The CRM applications market is poised on the threshold of a transformation with legacy installations being transformed into socially aware applications environments. Early movement has been observed for the last several years, Mary Wardley, program vice president of CRM applications at IDC, said in a prepared statement. An influx of new social vendors and acquisitions of social CRM applications providers by established vendors augmenting their offerings for rapid market entry is invigorating the market.' The activity is expected to continue through 2012 and bring new revenue to the space, she added.

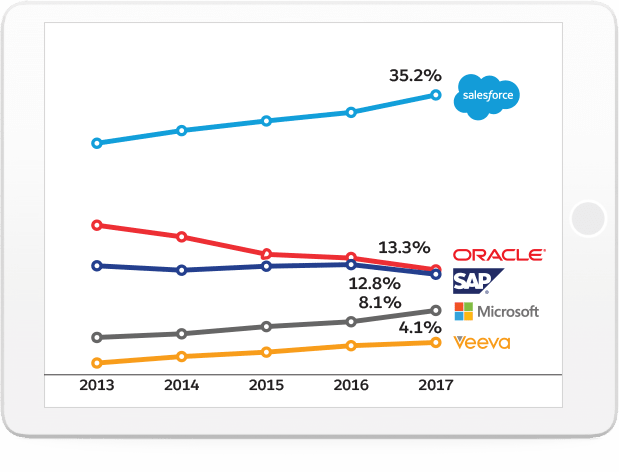

Average rating: 4 (from 261 votes)ByAn update to this report is available at. Top CRM Software Vendors by Market ShareCRM market share is used by vendors to demonstrate leadership, viability and the release of innovation that matters to customers. CRM buyers often consider this metric as an early stage indicator of which vendors to short list. However, more telling than market share position at a point in time is trajectory. CRM buyers often remain leery of vendors in sustained decline.Each year among top vendors. In this CRM market share analysis I've consolidated the annual data to show trending and filtered among the big 4 vendors in order to demonstrate some data driven findings, display some inherent challenges with the data and compare the results to another source.Source: Figures consolidated from Gartner annual market share releasesInitial take-aways:.

Many CRM pundits suggest that the Big 4 CRM vendors (Salesforce, SAP, Oracle and Microsoft) are increasing their collective market share. The data show otherwise.

When I sum all CRM vendors other than the Big 4, this group grew its market share from 46 percent in 2007 to 55 percent in 2014. CRM media often suggest that the combination of eroding Siebel market share coupled with an unclear CRM strategy make Oracle the market's top decliner. The data show SAP is the top decliner. There are increasing claims that Microsoft Dynamics CRM is the top challenger to Salesforce. If current trending continues this may be true, however, the data shows that Salesforce has more than three times the current market share and is growing its market approximately four times faster than Microsoft. This suggests that Salesforce is widening its market share leadership. Gartner advises that 2015 marks the tipping point whereby Software as a Service (SaaS) CRM revenues exceed on-premise.

The analyst firm further forecasts that SaaS CRM adoption will reach 80-85% by 2025. As cloud CRM is both the majority and higher growth delivery method, CRM vendors whose revenue concentration is heavily favored toward the cloud are better positioned to grow their market share than vendors with significant on-premise concentration. This bodes well for Salesforce, and to a lesser extent Microsoft, and will likely create even greater headwinds for Oracle and SAP. Gartner also forecasts the CRM software market with grow at a 14.8% compound annual growth rate (CAGR) through 2017, with SaaS CRM growing at 22.6%. CRM vendors which fail to grow their CRM revenues by these figures are by definition in market share decline.According to Gartner, the CRM software market reached $23.2B in 2014, up from $20.4B in 2013, representing a 13.3% annual growth.Source: Gartner. All figures in billions.The research firm also forecast continued growth with the CRM market reaching $36.5 billion by 2017. Further Analysis NeededGartner CRM market share analysis is based on two factors – estimated market revenues and individual vendor revenues.

I believe Gartner's estimated market size is solid. However, getting each CRM vendor's disclosed or estimated CRM revenues can be a tricky exercise. Large vendors such as SAP and Oracle may bolster CRM software revenues with products or product lines which are tangential to CRM. Microsoft chooses not to disclose its Dynamics revenue allocation between CRM and ERP.

Only Salesforce reports CRM revenues in a fairly straight-forward manner.So here's the rub. If Microsoft Dynamics CRM 2014 revenues were just under $1B, that would represent 4.3% - not 5.8% - of a $23.2B market. Similarly, if Salesforce reports CRM revenues of $5.5B its market share should be a whopping 25.9% and not 16.3%.I’m confident Gartner's market share allocation is directionally correct, however, to get another perspective I've been tabulating CRM visitors on CRMsearch.com since 2010.

In July my outsourced contact center asked 313 visitors what CRM software system they were using. Deducting the responses of visitors who were not using any CRM system, the data revealed the following.Source: CRMsearch.com annual tabulation; current year survey taken July 18-19, 2015; N=313Take-aways:. While CRM software market growth continues its low double digit evolution, how that growth is being allocated among CRM software vendors is incurring steady change.

Idc Pc Market Share

Salesforce continues to lead the pack, and its pace suggests it is poised to widen the gap. If existing trends continue, Microsoft, Oracle and SAP will near a convergence point next year.

Idc Crm Market Share 2017

However, viewing their trajectories shows two of these software publishes on the decline and the third demonstrating a growth trend that suggests it will assume the number two market position. CRM vendors other than the big 4 are gaining ground, suggesting the CRM market is becoming less top heavy.I’m not suggesting the CRMsearch.com tabulation is an empirical study or delivers a more accurate representation than Gartner. However, as long as CRM vendors lack transparency in CRM software revenue reporting, other sources need to be considered and compared in order to estimate which vendors are truly the CRM market share leaders.